Another crazy year has passed us by, and despite so much uncertainty in the world with continued shutdowns and staffing shortages, the stock market has once again performed very well.

The S&P 500 is up 27% for 2021, and small-cap stocks also increased. Although there were seemingly many knee-jerk investor reactions every time a Fed meeting was imminent, the market consistently bounced back from any drops. Anyone invested in the market, even the most simplistic market-tracking ETFs (which many investors will tell you is a wise diversified choice for many), did very well this year and last. Next I’ll take a look as always at my portfolio performance and discuss a few details.

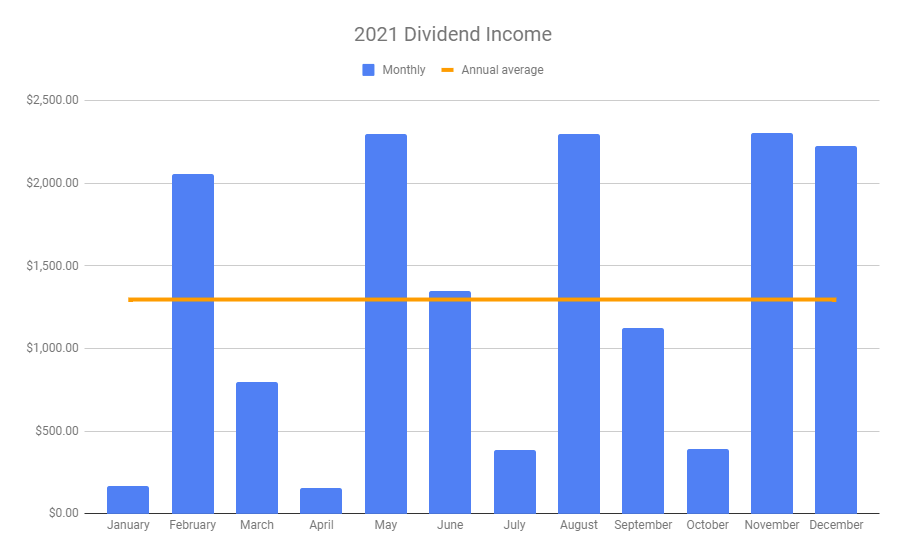

2021 Dividend Performance

My prediction from last year was a monthly income of $1,162 a month, or $13,948 (before taxes) for the year.

My actual average was $1,296 a month, which is $15,562 for the year. That’s 11.6% higher than I predicted, partially due to the incredible market performance we had this year, and partially due to a couple of portfolio changes I’ll discuss in a minute. Since I was 6% below my prediction in 2020, I’m pretty happy with this performance this year, although I don’t expect the S&P to keep climbing at this astronomical rate.

I also have an investment property that I expected positive cash flow on this year due to a refinance, but with lawn and maintenance expenses, that property is still breaking even for now, even with a rent increase in October. With the explosion in housing prices, however, the market value of the property is up a whopping 66% according to Zillow.

Stocks and Funds: Good Performers

Some funds did amazingly well this year. In fact, two of my worst funds from 2020 turned out to be my two best this year!

SCHF is a foreign-stock index fund with international holdings, and beat my predicted return by almost 60%.

VWO, which likewise has an international portfolio outside the United States, was 36% above expected based on 2020’s sub-par return. I’d considered selling VWO but didn’t want to incur any capital gains (dividends were down but equity is up), so I’m glad I held on to it.

Unlike 2020, international portfolios really made a comeback in 2021.

AGNC, a mortgage REIT I picked up a small amount of last year, has continued to pay out monthly dividends in the 9% range. I shifted a larger amount into the fund in April 2021, and it’s been a great filler overall but especially in the months of July and October when I have fewer dividends coming in. As interest rates contract, this dividend will almost certainly decrease at some point (interesting article here), but for the time being it’s been a great performer.

Stocks and Funds: Bad Performers

My worst performing fund of 2020, VNQI, is gone – I liquidated the position in March. I essentially broke even on the capital (long term loss of only $328) and benefited from the high dividend when it was paying out. I shifted the capital into AGNC, and have been much happier with a consistent monthly payout.

Carnival, once again, paid out no dividends this year. I optimistically expected cruise travel to fully resume after the first round of vaccinations in Spring 2021, and… yeah, that definitely isn’t happening, at least for a while! This was always a long term play, so I’ll plan to hold until at least 2023 to see what happens.

Surprisingly, REITs, specifically VNQ and FREL, returned lower dividends (11% and 15% below expected, respectively). While inflation and the possibility of interest rate increases will affect price, I didn’t expect to see such a marked drop in dividend return here.

2022 Outlook

I know I said this last year, but now more than ever, the future is anyone’s guess. With rising inflation, the great resignation, continued Covid breakout strains, meme stocks, and the possibility of four interest rate hikes, the future is very uncertain.

Here’s what we do know:

- The market is up 80% from two years ago (January 2019), so anyone who was invested has already made considerable gains

- The “W” shaped recession economists feared in 2021 never happened, despite new virus strains and continued shutdowns

- Unemployment in December 2021 is at 3.9%, a complete recovery to pre-pandemic rates

I remain optimistic that 2022 will be a solid year of slow but steady recovery, reopening, and new job growth as people pursue their dreams. Index tracking ETFs are still the safest place to hang out and hold for long-term growth. I don’t think the explosive growth of the S&P that we’ve seen is sustainable, so I expect to see some tempering and decreases as interest rate hikes kick in. The lumber and semiconductor crises are likely to keep price pressure on housing and cars into mid-2023, in my opinion, both have market conditions that will require a lot of time before we see a major correction.

Thanks for reading! Feel free to contact me with any questions.