Some people love it, some people hate it. Many know they should but don’t, harboring guilty feelings in the dark, like eating ice cream at midnight. Let’s talk investing.

Disclaimer: I am one of those people who has never particularly liked the intricacies of market investing. However, I do believe many people think it’s more complicated than it is, and avoid it entirely out of fear. I’m therefore going to keep this article super simple and focus on high-confidence, easy approaches. What you need to remember is there are many highly diversified index trackers that, in the long run, will almost certainly yield returns. You also need to remember that doing nothing is, in fact, moving backwards – inflation has been around 2% for the last two years.

Exchange-Traded Funds

ETFs have become very popular in the last couple of decades (prior to which, conventional wisdom often invested in mutual funds). A single ETF has many holdings inside of it, often comprising thousands of companies, and charges a very small fee to you, the buyer, for management – often less than 0.1%.

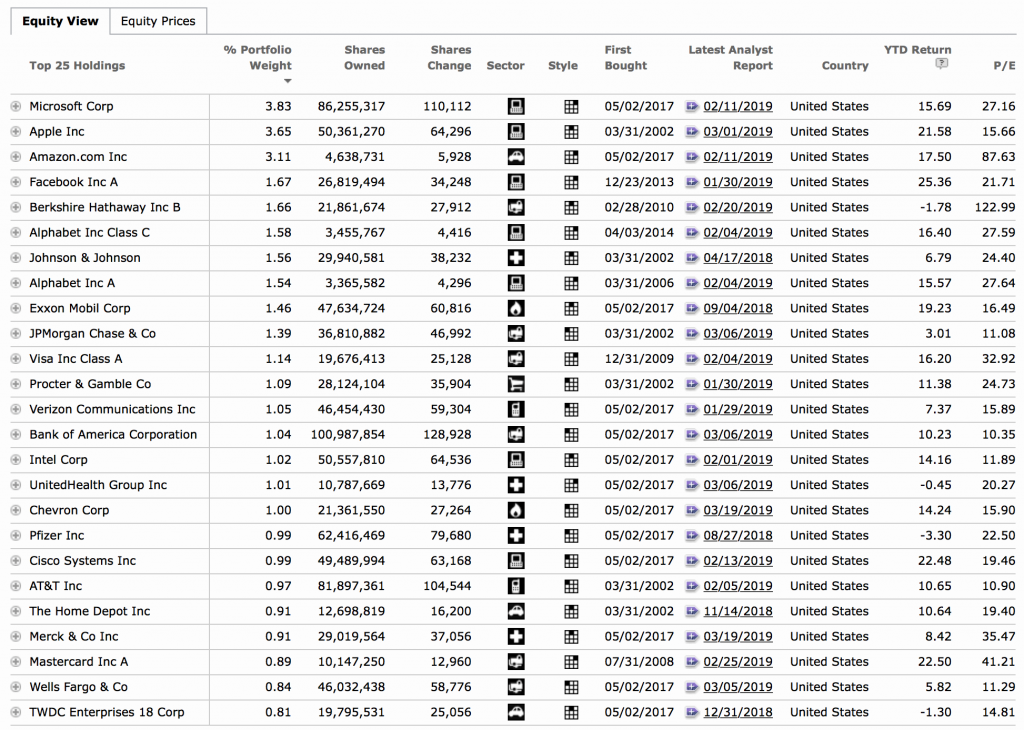

Example: SPY, one of the oldest ETFs that is set up to mimic the performance of the S&P 500. What’s inside it?

As you can see, these funds are already highly diversified (SPY has over 500 different holdings). They’re meant to be. You don’t have to buy 50 stocks of your own to maintain a balanced portfolio, the fund has already done that. The caveat here is, these are all companies on the American stock exchange, and they’re all large (above $6 billion in stock shares).

Roboadvisors: Betterment vs. Wealthfront

Back in 2013, I started to take a look at robo-advisors, thinking it’d be an easy place to let my savings work for me without any work on my part. These are services that invest your money for you based on software algorithms, instead of an actively managed account where a real person is doing the investments. An actively managed account can cost 1-2% annually. Roboadvisors charge about 0.25%, balance your account regularly, and usually invest in low expense ratio ETFs that only tack on an extra 0.05-0.1% to that cost. These have gotten so popular (and lucrative) now that even the big brokerage firms, Fidelity, Vanguard, Schwab, and so on, have their own versions, but five years ago it was still emerging.

At the time I was looking, there wasn’t a lot of data available on these services. So I decided to invest $5000 in both Wealthfront and Betterment and track their performance across a six-month period, November 2013 to May 2014.

Six-month gains

Betterment: 6.5%, -$10.95 in fees

Wealthfront: 4.6%, $0 in fees (under $10k)

Betterment also won for ease of use, user interface, and tax statement delivery – they arrived a full month sooner than Wealthfront’s. Wealthfront also held a small amount in bonds and cash even at the maximum risk level, which I didn’t care for. I shifted a bunch more money over to Betterment in 2014 and 2015.

Do I use it today? No. Why not?

First, they increased their management fee from 0.15% to 0.25% and did a poor job of communicating it. (The CEO later apologized for how it was handled, but the damage was done.) Second, the tax-loss harvesting, which I won’t go into here, makes tax preparation quite complex, with hundreds of transactions in your account for what I perceived to be very little gain.

Third, performance.

When I moved my Betterment account to Vanguard, it had appreciated about 30% over 3.5 years. In the same time period, SPY had appreciated about 40%. Now, Betterment had a wider diversity of some bond ETFs, international indexes, and so on that slowed growth, but overall I didn’t see the value for my money anymore.

Conclusion (What, already??)

Yes, already, and here’s why. There are tons of blogs out there that will go into great detail on investment strategies. Most of the people I know are basic investors with basic questions, and don’t want to do five hundred hours of research to hone their portfolio choices. Let’s cut to the Chase.

My bank (Chase) currently offers a 0.01% interest rate on checking accounts. Yes, a tenth of a TENTH of a percent. But what about savings, Matt? Surely that must be better. It sure is, three times better – 0.03%. The bank is a place for emergency funds and money you intend for transactions, and nothing more.

The reality is, whether I gained 30% in Betterment or 40% in SPY, they’re both hundreds of times better than what the bank would have offered me. So whatever you choose, as long as you stick to tried and true major index ETFs and don’t dump all your money into penny stocks, is going to work out just fine and benefit you tremendously in the long run. Don’t forget, money in ETFs is still liquid. If, in an emergency, you need access to it, you can sell and have that money in your account within days.

My advice: Don’t try to time the market. Don’t day trade. Don’t buy individual stocks, even if your buddy’s uncle has a hot tip (at least not at first). Don’t obsess over what “the best” is. If you’re still at least 5 years away from retirement age, get big funds like SPY, VOO or VTI and hold on to them, they’re a great choice. Once you see gains and start to get comfortable, you can branch out in the future. (Please note as a disclaimer, since the internet is a litigious place: the above is offered as my opinion, you should seek advice from professionals before investing. And if you do, make really, really sure they’re a fiduciary acting on your behalf, not a fake advisor ripping you off.)

Appendix

I have recently been shifting some of my finances around to live off passive cash flow as an short-term experiment. By choosing high-dividend ETFs like VYM, REITs like VNQ/VNQI, and to some degree even growth stocks like VTI, and cashing out the dividend payouts instead of reinvesting, you have a completely passive income stream.

Now, most investors hate talk of any short-term gain at the expense of long-term growth. They will spend all day telling you why reinvesting makes more sense in the long term, the wonders of compound interest, just sell growth stocks when you need to pay yourself, etc., etc. However, dividend payouts are still perfectly viable investing, if slower. You’re still growing a portfolio for the future while generating income. Older folks have done this for decades with AT&T and IBM stock, both historically pay high dividends. And to me, this strategy fits in nicely with the “enjoy your life today, stop planning a deferred life after 65” mentality that’s popular now, and has always personally resonated with me.

So if you’re interested in hearing about in-kind transfers between brokerages, living off dividends, and real estate investing, stay tuned for a followup post.