Passive investing is a huge buzz phrase right now. There are tons of blogs covering it, like Sam Dogen’s at financialsamurai.com where he generates over $200,000 a year through a combination of real estate, stocks/bonds, and eBook sales. He doesn’t include his website revenue, because it requires regular maintenance and updates, aka “work”.

Often the message conveyed is something aspirational like “break free and live the life you were meant to”, perhaps with a picture of a cocktail on the beach.

Maybe you don’t want to quit your job and sip drinks on the beach all day, but you’re looking for some small amounts of additional money coming in. I’ll be continuing this series with a super-basic description of passive income generation and examples.

Passive Income: What is it?

Last year, I made $575/month in dividends. I was surprised when I did the math for tax season, my portfolio is set up for growth (appreciation), not income. $6,900/year isn’t something you can live on, but it’s a reasonable amount to cover some bills. How does that even work? How would someone set up an account to get regular income for living expenses? Let’s dig in.

Ground Zero: Savings Accounts

Most of you probably have a savings account with the bank. They pay you a small amount of interest in exchange for holding on to (and using) your money. However, it’s typically a dismally small amount. Chase Savings currently offers just 0.03%. At the time of this article (April 2019), there are high yield savings accounts, typically online only, offering up to about 2.2%. This is 100% risk free money that’s FDIC insured.

The only real caveat here is that the rates are not guaranteed long-term, so the bank can change the interest rates at any time. Back in 2007, HSBC peaked up to a crazy high 6% interest rate on their online savings account. When the market tanked in 2008, that quickly dropped, crashing down to 0.8% and eventually bottoming out at 0.01%.

Next step: Treasury Notes and CDs

Both Treasury notes and certificates of deposit, similar to a savings account, pay you an interest rate in exchange for using your money. They are both almost risk-free. Unlike a savings account, however, there’s a set time they hold your money – e.g., 1 year for CDs, or 10 years for a Treasury note.

Higher risk, higher reward: Getting into ETFs

We covered ETFs in the last article, these are funds with many different company stocks in them. Some choose a portfolio with a high number of company stocks known for issuing regular dividends, and dividends that increase over time. A conveniently named example from Vanguard is VYM, “High Dividend Yield ETF”. Easy, right?

A popular real estate investment trust, VNQ, adds a bit more risk by concentrating their investments in the field of real estate. REITs typically have high yields since they’re required to distribute 90% of their earnings to shareholders.

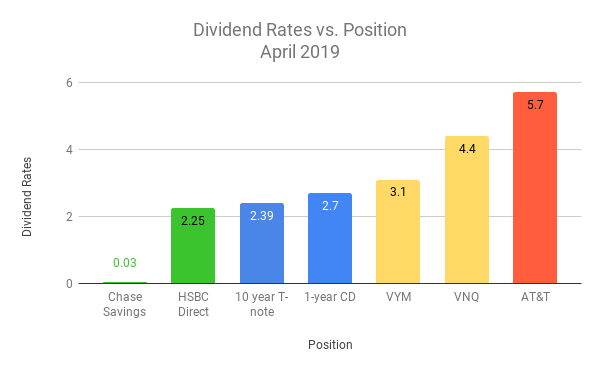

Basic Dividend Ranking

Above is a chart of current rates for April 2019, with increasing levels of risk. At the top here is a classic individual dividend stock, AT&T, currently paying out a high dividend percentage as a result of the purchase price falling to a five-year low.

This chart doesn’t tell an effective story, though. Let’s add in inflation as a negative effect. In 2018, this was 2.4%.

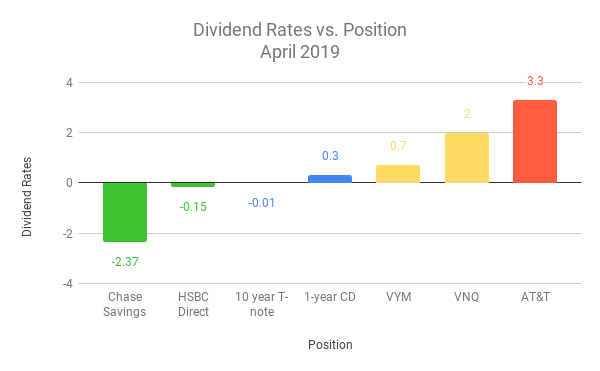

Dividend Ranking with Inflation

This illustrates why holding large amounts of your money in a bank is a bad idea. Inflation is decreasing your buying power all the time. Not only can ETFs like VYM help you stay ahead of inflation, your capital also has a chance to appreciate over time, though not as much as growth ETFs. VYM has gone up 37% over the last 5 years (compare to the S&P 500, which went up 55%).

AT&T, by contrast, has lost 13% of its value in the last 5 years. So although it looks great on paper for its dividend yield, it’s a higher long term risk. Ideally, you’d like to both generate income and have some growth potential for your capital.

How about an example: VYM

Let’s say you invested $20,000 in VYM in January 2017, and chose to receive your dividends instead of reinvesting them. By March 2019, your $20,000 would be worth $22,500 (12.5% increase). Additionally, you would have received $810 in 2017 and $700 in 2018, paid out every three months. That averages out to about $63 per month, while your capital still continues to grow.

This is a basic example of investing for passive income. We’ve ignored expense ratios – tiny fees the fund charges for management – in the case of VYM, it’s just 0.06%. We’ve also ignored taxes, most of which will be at capital gains rates (REIT income is taxed higher at standard income rates).

Conclusion

Growth investing is one strategy that many people are familiar with and use. Income investing is not as familiar, so I hope this example piqued your interest.

I’m experimenting with income investing this year, shifting some of my funds to different investments and drawing out the dividends. I’ll post an update here when I have my first round of payouts.