Last year, I decided to quit my job and take a sabbatical. I’ve talked about it before in a previous post, but a couple of my goals were to spend more time with my family and do some travel. I maintained my dental and vision coverage through COBRA since it was reasonably priced ($66/month), but healthcare would have added another $600 a month to that figure, and I couldn’t justify that. I maxed out my HSA contribution first, to provide me with a small safety net, and decided to go without coverage for a while.

As I write this in April 2020, COVID-19 has been sweeping across the world, characterized by that word we’re all getting sick of hearing, “pandemic”. John Hopkins has created a tremendously good visualization map, and presently the United States has over 670,000 cases. 224,000 of those are in New York, exactly 1/3 of the entire country.

Did I mention my family lives in New York? Now that I can’t travel, that I’m also living in New York? And that I didn’t have healthcare?

The few thousands I’d saved would cover minor emergencies, but definitely not extended hospitalization, should it come to that. Hospitals in NY cost an average $2,800 per day.

I’d been researching insurance options on and off for more than a year, since before I quit, but now I needed to decide on an option, quickly. In this article I’m going to go through in some detail what I looked into, and ultimately chose, in the hope that it will encourage others and demystify the process for those who are looking for answers in the hugely complicated world of private health insurance.

Private Health Insurance can be mysterious

Many of my friends have no idea about private health insurance options, because they’ve never used it. Like quite a few people out there, they’ve only ever had healthcare coverage through their employer, or, the same benefits through COBRA, strictly to bridge them through a short unemployment period. If they got a good severance package, their former employer might have picked up several months of that payment, but a lot of people end up paying that exorbitant cost for months until they can land a new job.

Maybe you’re in the same situation. In this case, my network was of limited use for advice on longer-term private health insurance options. As I researched I found a dizzying array of options, which I’m going to separate into Typical and Atypical. Options vary by state, I’m going to give examples for New York.

Typical Options

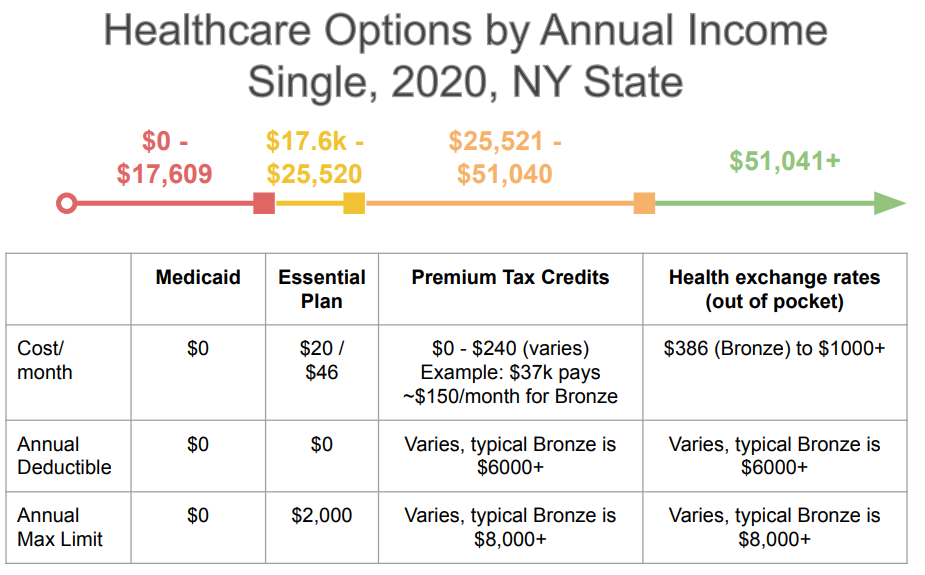

The chart above shows the typical “full” healthcare options available in NY. I’ve never seen them visualized in a simple way, so I created this chart referencing income and coverage details from the NY State Health Marketplace as well as supporting information elsewhere.

Medicaid is the first tier. It’s available to very low income households and also has an asset limit ($15,750). If you qualify, however, coverage is free, there are no monthly premiums or deductibles.

Essential Plan is the second tier. It’s available to individuals making up to 200% of the Federal Poverty Level (FPL is $12,760 for 2020). In the words of the fact sheet: “It costs much less than other health plans, and it offers the same essential benefits.” Basic coverage is just $20/month, or $46/month with added dental and vision coverage.

Premium Tax Credit is the third tier, and the first where you have a choice of plan on the exchange. Tax credits are offered to individuals making up to 400% of FPL, and these credits can be paid directly to the insurer to substantially reduce the monthly premiums.

In the fourth tier above the ~$50,000 mark (400% of FPL), you’re on your own: the government aid cuts off at this level, but you can still use the state’s healthcare exchange to choose a plan. Whether or not they are “affordable” at those levels is debatable, but the Bronze plans start $200 less per month than the coverage I would have had through COBRA, so if you’re a higher-income person being laid off, don’t discount looking into this.

Medicaid and the Essential Plan are straightforward, there’s no reason I can think of why you wouldn’t jump on these plans if you were eligible. Let’s spend some more time talking about premium tax credits, which probably apply to a lot of folks that are self-employed.

Premium Tax Credits

As described at healthcare.gov, if you qualify for premium tax credits, the state can can send advance payments directly to your insurer to reduce your monthly premiums. These plans come directly from the exchange. In essence, the government is subsidizing your cost – you pay $1, they pay $2.

The examples in the chart are just for a single individual in New York, you can check your own eligibility in your state here. For frame of reference, here’s what I found:

- If you fall at the extreme low end of the range, the credit is over $400 a month – enough to fully cover the cheapest Bronze plan (at $386). You pay nothing.

- If you fall in the middle of the range, the credit is $240 a month. Thus you’d pay $386 – $240 = $146 a month.

- If you’re at the top near that $50,000 mark, you still get $140 a month in credit, and therefore pay $246 out of pocket, again for the cheapest Bronze plan.

Honestly, if you fall in the range to get tax credits, it’s a pretty good deal. I didn’t have a reference point and expected worse. At the midpoint, you’re only paying 4.6% of your income for healthcare coverage.

Atypical Options

The options outside of the Affordable Care Act exchange are many, and seem to vary in quality from ‘decent if you understand the restrictions’ to ‘total garbage’. Let’s discuss a few.

Healthcare Sharing Ministries

These are most often recommended by full-time RVers that travel all over the U.S. and may not have a fixed residence. I really like the concept of the idea: instead of paying a private company to profit off of healthcare, all members pay into a pool of money, that’s then shared among those who experience medical needs. It’s necessary to pay out of pocket for expenses and then submit a claim for reimbursement.

Again, while I like the theory of this approach, the logistics are not ideal. First, many people may not have the ability to pay thousands of dollars up front for medical care. Second, payments are not tax deductible as either a medical expense (typical insurance is) or as a charitable donation.

Third, there’s always a risk that the company may not come through with reimbursement in a timely manner or at all, either because they’re oversubscribed, because your injuries were a result of breaking their restrictions, or an unknown slowdown. These bloggers used Liberty Healthshare, one of the biggest groups. They paid $10,000 out of pocket for their pregnancy, and seven months later, still hadn’t been reimbursed a dime (it’s supposed to take only 30 days).

There’s more information on the risks of these groups here, which notes “the Ohio Attorney General’s (AG) office has received 18 complaints regarding Liberty HealthShare so far this year [June 2019]”. The article also notes “there typically is little state officials can do to remedy the complaints, because the ministries are not regulated by state insurance commissioners and many states have passed legislation protecting the ministries from state oversight”. Imagine paying your premiums for years, not being reimbursed when you do have a major medical expense, and then being told there’s nothing you can do about it.

Edit: More on another family’s poor Liberty experience here, referenced by the New York Times.

With all that said, these companies are struggling with, in some cases, 500% growth in four years. Putting aside any ill intent, odds are that they simply can’t keep up with that explosion of claims. In the blogs that I read, Samaritan Ministries did have a good reputation. The incredible growth of these organizations should demonstrate how much of a need there is for lower cost, nationwide coverage without enrollment periods (the factors that draw so many to this arrangement).

Short Term Health Insurance

These policies are sold directly by insurance companies, and are not on the healthcare exchange. They cover less, usually don’t cover pre-existing conditions, and don’t have to guarantee renewal (something to consider if you get ill near the end of your policy). Policies range in duration from 30 days up to 12 months. The downsides of these policies draw a lot of criticism. The advantage is that they’re much cheaper than regular insurance on the ACA exchange, if you don’t qualify for credits.

These plans are actually forbidden in both New York and California, as well as a few other states. You can find more information here, along with places to get quotes. With Miami Florida as an example, a 6 month plan with a $10,000 deductible and other fine print is $160/month.

For a healthy person that understands the restrictions, particularly if just spanning a gap between jobs, this may be a reasonable choice, but you’ll need to do your research.

Catastrophic Plan

These plans are actually on the ACA exchange, but are only available to people under 30, or 30 and older who qualify for a hardship exemption. Despite the name, these plans actually must have all of the same essential benefits as other policies on the exchange, but have higher deductible limits. There’s a lot more information here.

If you’re in your 20s and make just enough not to qualify for tax credits (say $55,000), these plans might be more affordable in your state. If you’re in your 30s at that same income level, this is one of those “hidden” plans that might be a good option for you if you can get an exemption.

Critical Illness/Hospitalization/Accident Insurance

This is where we start to get into the realm of extreme limitations and fine print. These policies are not health care plans, only cover very specific conditions, and at most are usually treated as an add-on to existing insurance, not a stand alone policy. In fact, the insurers themselves usually put this disclaimer on the sales pages: “These limited benefits policies are a supplement to health insurance and are not substitutes for major medical coverage.”

Consumer Reports has more information here and says “for many, critical illness insurance is rarely worth the money.”

However, for some, these policies offer greater peace of mind than having nothing at all, and are very inexpensive. Hospital or Critical Illness policies range from $10-20 a month, and pay out fixed amounts based on certain events such as a specific illness or a hospitalization.

Accident insurance is slightly different, and pays out for a variety of emergency events such as bone breaks, lacerations, burns, and so on, along with the accompanying ambulance and hospital payouts. Costs are the same, about $10-20 a month, depending on coverage, here’s one example. I actually had this kind of policy for a year when I was in college – my dad lost his healthcare coverage, and I needed to have something on file to comply with university regulations. This worked at the time, was nice to have for peace of mind in case of a broken arm or ambulance visit, and it cost something like $130 for the entire year.

With the Affordable Care Act, nobody should really have to rely on something like this as their sole coverage. Either your income will qualify you for something reasonable, or above $50k but still in hardship, you can make one of the other options here work. In my opinion, this is a last resort option, or to be used in addition to another plan. There are some cases where this will pay out when your regular insurance won’t. Let’s talk about this a bit more below.

Devil’s Advocate View: Where high deductible plans fail

The major downside of a high deductible plan is… the high deductible. Insightful, I know. Bear with me for a moment.

For many scenarios, whether you’re healthy or have pre-existing conditions, having a high deductible healthcare plan is identical to having no insurance at all.

- Sick and need to see your primary care physician? You’ll probably pay $100 out of pocket.

- Break your arm? Ambulance ride, ER, X-rays, physical therapy? You might pay $2,000 out of pocket, insurance covers $0.

- Managing Type 2 (adult onset) diabetes? Primary care visits, tests, prescription drugs, glucose meter? Once you pay out thousands to hit the deductible, plus copayments, plus coinsurance, you’ll probably pay $6,500 while your insurance picks up a few hundred bucks.

Ironically, in the broken arm scenario, that cheap accident insurance would be more useful than your expensive, “real” insurance.

You’d get $250 for the ambulance, $50 for an X-ray or $200 for a CT scan, $150 for the ER, more for the doctor’s procedures to set and cast, and $40 a day towards physical therapy. The policy that cost you $180 a year just covered perhaps $1,200 of your expenses, while the insurance you paid $4,800 a year for covered $0.

This sucks. Unfortunately, it’s how high deductible plans work. A low deductible plan will probably have out of pocket premiums of $1000/month or more.

Major medical procedures must be better, right? That’s really where health insurance protects you?

Two of my coworkers had emergency appendectomies one week apart last year, so that caused some office conversation. They were in and out in a day, and their costs before insurance were almost $40,000. In their cases, insurance saved them a bundle, and they were really happy to be insured.

Other cases are not so lucky. This 20 year old in Sacramento got an appendectomy bill for $55,000 in 2013; insurance covered $43,909.78, he still owed $11,119.53. Another recent example cost $41,212, where the patient – with insurance, mind you – was still charged over $28,000.

Did healthcare save money in these cases? It definitely did. Is $11,000, or $28,000, an affordable amount to pay for a relatively common surgery? Absolutely not, it’s a huge amount of debt for individuals with coverage.

Wouldn’t many people, therefore, be better served foregoing high deductible plans and putting that $400/month away themselves in a dedicated account for medical expenses?

That’s a difficult question to answer. I don’t believe the current structure of healthcare is well suited to most people’s needs. You pay too much for too little. It’s difficult to discuss a cost benefit analysis of healthcare, because there are a lot of emotions involved. Maybe there have been serious illnesses in your past that ran up large bills, either for yourself or family members. Maybe you’re healthy but can’t stop thinking about those “what if” scenarios. When a routine one-day appendectomy can cost $40,000, and major critical illnesses climb into hundreds of thousands, those are difficult situations to ignore.

My Choice: Bronze ACA Plan

If you fall in the range of premium tax credits, the options really are affordable. I stated my dividend income in a previous post, I expected to make about $14,300 this year (though that was before the market tanked). I have a mortgaged rental property that I pump all of the rent back into for payments and principal reduction, so I effectively net zero cash flow from it, but on paper I make $23,400 from that a year, putting my total predicted 2020 income at $37,700.

At this income, I was eligible for a $241 monthly tax credit, and opted for the cheapest Bronze Plan, a Fidelis Care HMO with a $4,425 deductible. I pay a monthly premium of $145.67. With the exchange flooded during the special enrollment period for COVID-19, it took days of work and over 8 hours of phone calls to complete, but I’m grateful to have coverage.

A $4,425 deductible is still high, but lower than others in the Bronze tier. Plus, the routine coverage is actually usable. Even on this budget plan, telemedicine services are free (a great benefit, video calls to doctors from the comfort of your house), and three primary care visits are included per year in addition to regular preventative care like flu shots. Immunizations and a sick visit to get a simple prescription are typically the only ways I use my healthcare anyway, and those are free with this plan.

Conclusion: Don’t think no coverage or outrageous costs are your only choices

I sincerely hope that others out there despairing of choice, like I was, are encouraged by these options, and take the time to research and pursue one. There really are some good choices out there for almost every income bracket.

Having lived in expensive metros like the Bay Area, I also totally understand that some of you make too much money for aid, but the costs of living consume almost all of it. I hope the alternatives here give you some ideas.

Thanks for reading, and please comment or reach out if this was helpful. I’m also curious to hear from anyone that may have used their policies in the past, with either positive or negative results.