As I mentioned in the previous blog posts on investing (Part 1 and Part 2), one way to generate passive income is through dividend stocks and funds. Today I’m going to walk through my investments, discuss some numbers, and provide some simple information if you’re interested in pursuing passive income yourself.

Dividend Basics

First, it’s important to realize that not all funds have dividends. Some don’t. Many tech stocks in particular, such as Alphabet/”Google” (GOOG), Amazon (AMZN), Netflix (NFLX), and so on don’t offer any dividends.

Some stocks, such as Apple, pay a low dividend (say 1.4%, we’ll cover this in more detail below), while others may offer very high dividends, like AT&T at around 6%. That doesn’t mean you should you invest everything in AT&T; as we discussed in Part 2, it’s actually decreased in value over the last five years, while Apple for instance has doubled in value over the same time period. It’s important to maintain a balanced approach. ETFs can really help here, since they’re already highly diversified, as we discussed in Part 1, and can also pay out dividends.

Investment Companies

I have investment accounts with Vanguard, Fidelity, and E-Trade.

Vanguard holds my Vanguard-specific ETFs. They have commission-free trading on their own funds, which are some of the best out there, but their website sucks. There are logistical details, like the landing page resetting itself every other day, but worse it’s much more difficult to do simple tasks like see your total gain/loss on a fund or sort a column by dollar amount or number of shares. I love their funds but hate their website, I can’t recommend them for beginners. It’s rumored a major overhaul might be coming in 2020.

Fidelity has my IRA as well as my individual stocks. Their website is easy to use, it has greater transparency on performance and is clearer about tracking transfers and outstanding trades. This is the one I recommend beginners start with.

I have E-Trade solely for Apple stock, because my employer uses them. (I also have Empower Retirement for my company 401k, which is absolutely terrible for support and website services, though they do use Vanguard funds.)

Specific Holdings

In Vanguard, I have VNQ and VNQI (real estate based ETFs), VYM (high dividends), VOO (S&P 500) and VTI (total stock market exposure), along with a few others. VNQ, VNQI, and VYM produced about 3-4% annual returns last year. VOO and VTI were lower at 1.8-1.9% in 2018, but again, the dividend there is more of a bonus as these are low risk index trackers not specifically meant to generate income.

In Fidelity things are riskier with some individual stocks, namely AT&T (T), Kraft Heinz (KHC), Taiwan Semiconductor (TSM), and a few other non-dividend producing stocks. I also have a REIT ETF, FREL, which can be thought of as Fidelity’s version of VNQ (though much smaller in scope) that generated about 5% returns last year, as well as SPY, the classic S&P 500 index ETF (1.9% return, basically identical to VOO, as it should be). AT&T’s stock price fell so much last year that their dividend was a very attractive 6%. Kraft paid out about 4% last year and has since crashed down from about $60/share to about $32/share, it’s been volatile so it will be interesting to see what happens in 2019. TSMC is another tech stock that also pays dividends, they paid out around 2.5% in 2018.

As I mentioned E-Trade is specifically for Apple stock (Disclosure: Apple is my employer). There was a lot of fluctuation in the stock price in 2018, but at an average of $185 across the year, paid out about 1.5% ($0.73 every quarter per share).

2019 Dividend Income Projection

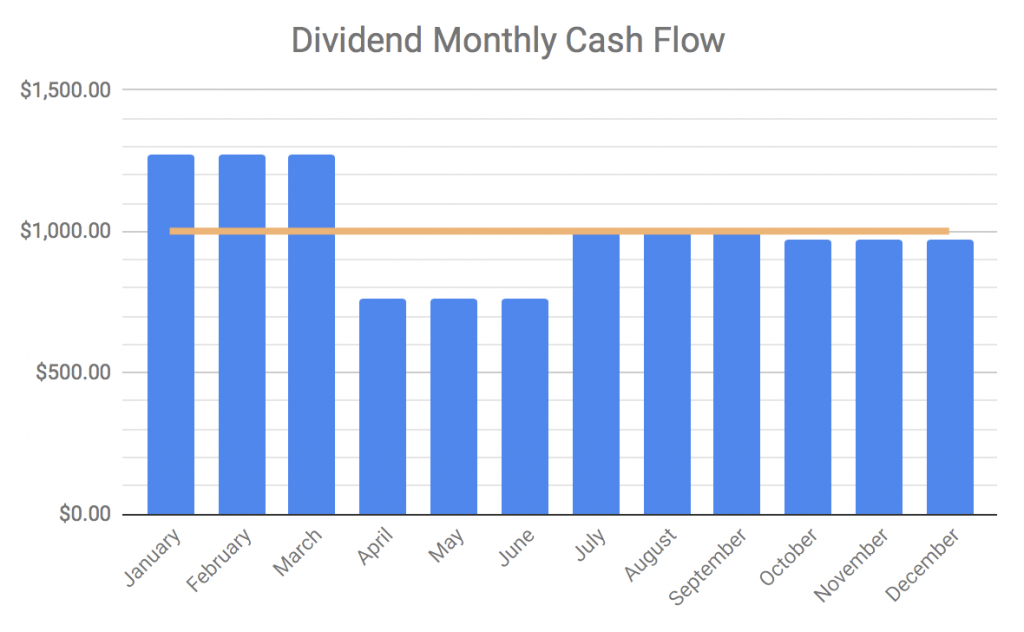

With the holdings above, and a prediction based on past performance, I’m looking at the following for 2019.

I gave some background in Part 2 and mentioned that I generated about $575/month in dividends in 2018. Rebalancing into some of the holdings mentioned here, I should average about $1000/month ($1,001.08 based on 2018) before taxes, just over $12,000 for the year. The numbers are higher January through March since some funds only pay a dividend once a year in late December versus quarterly. I’ll be pulling the cash out versus re-investing and reporting back here.

Side Note: Pay attention to the “ex-dividend date”

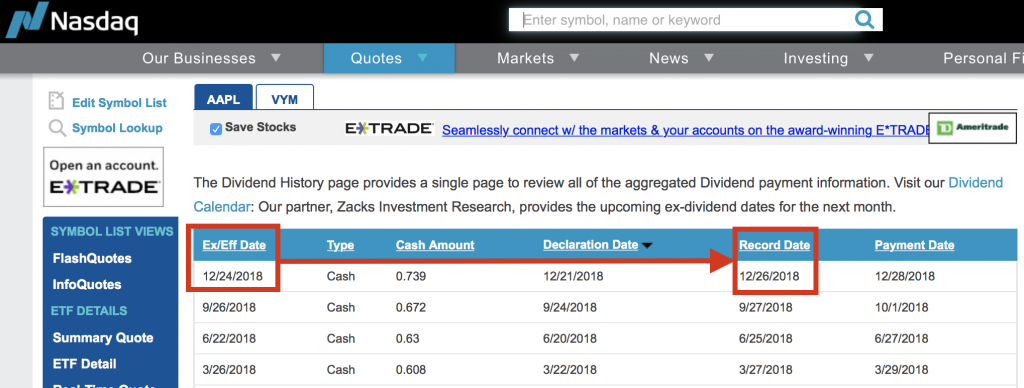

When exactly you need to hold a fund to get paid a dividend can be particularly confusing and has burned many people judging by the amount of forum threads and Quora articles on it. Simply put, you need to hold the fund at least one day before the ex-dividend date, which is in turn one business day before the record date. You can look these dates up at many financial sites, here’s an example on VYM from Nasdaq.com.

If you had held VYM as of 12/23/18, you would have received the dividend payment of 0.739 cents per share. If you purchased ON the ex-dividend date of 12/24, the seller gets to keep that dividend. You have to hold it before, not on, the ex-dividend date.

How could I get started?

First, you’ll need an investment account. I recommend Fidelity right now, they’re user friendly. Second, I strongly suggest you prioritize index tracking ETFs first (as discussed in Part 1) versus individual stocks. If you wish, spend $50-100 on a few shares of a cheap stock like T or TSM in addition to your main account, just as a learning experience. And third, since you’ll usually be charged a commission per trade, group your purchases into just one or two larger transactions instead of many small ones. (Once again, please note as a disclaimer, since the internet is a litigious place: the above is offered as my opinion, you should seek advice from professionals before investing. And if you do, make really, really sure they’re a fiduciary acting on your behalf, not a fake advisor ripping you off.)

Conclusion

Generating income from dividends isn’t black magic, it’s as simple as buying a fund that pays a dividend, before the ex-dividend date, and selecting Cash in your account instead of Re-invest. Generating enough to be livable wages is, of course, a whole different ballgame. I’ll be posting more updates on this experiment throughout the year, please let me know if there are other details or areas you’d like to see covered.