When I posted my 2020 predictions back in January, I casually threw in a typical financial statement of caution:

“Everyone has seen those “the past is not an indicator of performance” disclaimers, which is of course true, so predictions are just that – estimates that could easily be affected by market changes.”

Well, I think it’s safe to say nobody saw 2020 coming. Not even the guys from The Big Short.

Here’s my year-end look back at the market, updates on my financial experiment in generating income from dividends during my sabbatical, and a quick look forward.

Stock Market Performance in 2020

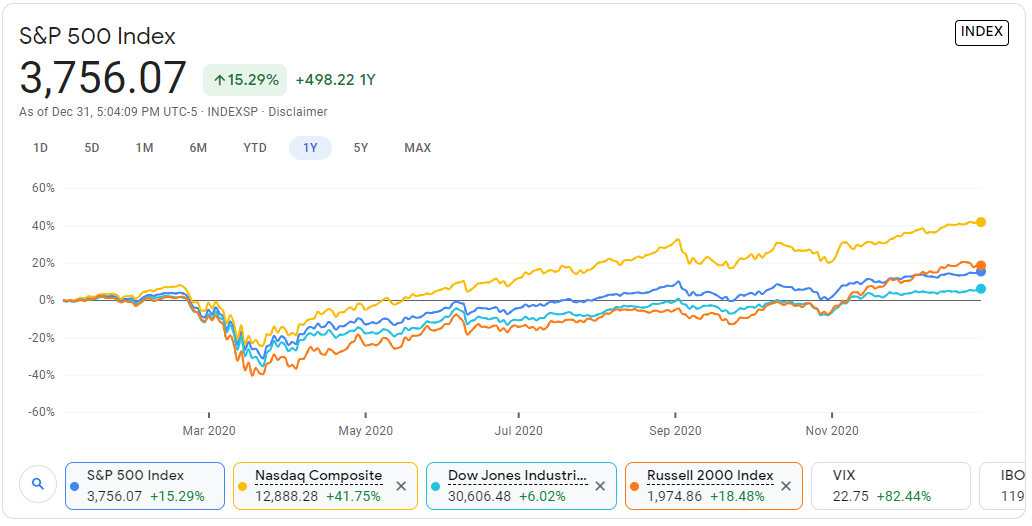

The National Bureau of Economic Research formally declared on June 8th, 2020 that the U.S. was in a recession, the first since 2009. Despite the chaos and turmoil the world is still in as we start off 2021, market conditions had already recovered from the spring crash by the end of the year. In fact, the S&P 500 is up about 16% across the year. Crazy, right?

Is this only true for huge corporations? No, all of the indexes are up. The Russell 2000 looks at small-cap companies, and that’s up over 18% for the year, even better than the large cap companies.

This is easily understood for companies that benefited from working at home, like Zoom (whose stock went up 700% in ten months), and other companies that benefited from increases in home living, but I’m pretty astounded that things bounced back this quickly. I’ll share more of my thoughts on this at the end; for now, let’s look at some specifics of where I ended up.

2020 Dividend Performance

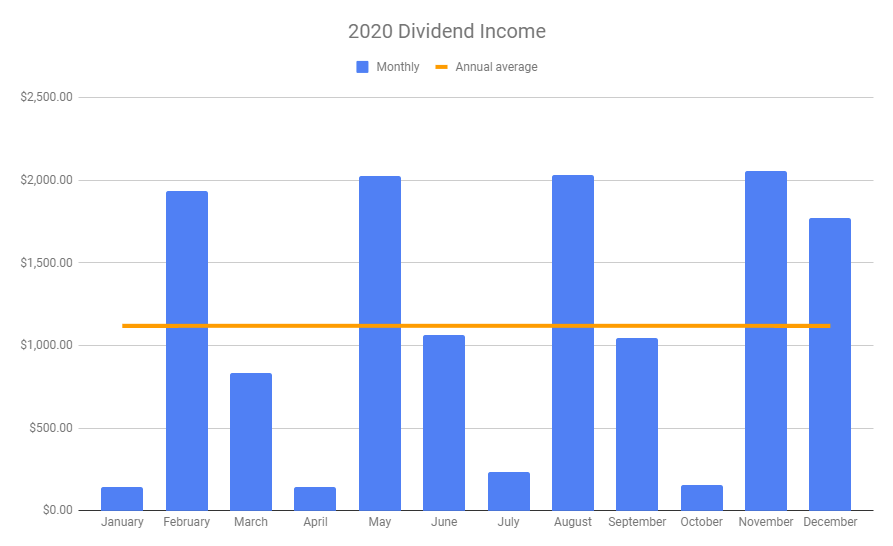

My prediction in January was an average monthly income of $1,191 before taxes, for a total of $14,300 for the year.

My actual average was $1,119/month, for a total of about $13,400 for the year. That’s 6% less than I predicted at the start of the year. All things considered, I’m pretty happy with that result, and the market upswing increased the equity position on most of these as well.

You can see that the distribution is very inconsistent across months, but having a split of stock and ETFs does help contain big decreases to just four low months in January, April, July and October.

As a side note, with historically low interest rates this year, I also refinanced the mortgage on my rental property. Usually I don’t have much, if any, cash flow from that (just appreciation), but the new lower payments should net me $200 a month. I’ll be tracking it this year and will start to include it here if it trends positive over time.

Stocks and Funds: Good Performers

In my portfolio, most stocks and ETFs actually performed as well as expected or slightly better.

I picked up a new fund in April, AGNC, which is a mortgage REIT that holds real estate debt, primarily from mortgage backed securities issued by Fannie Mae and Freddie Mac (i.e., backed by the U.S. government). It pays a dividend every month, and although I don’t own much, it provides a nice filler for the down months.

Stocks and Funds: Bad Performers

My worst performing fund was VNQI, an international real estate ETF. Although its counterpart VNQ, for the U.S. market, did fine (6% above predicted), the international fund got hammered and paid out only 12% of what I expected compared to last year. That was a hit of over $1,000. In addition to that, equity decreased over 8% for the year.

VWO is an emerging market ETF with 99% of its portfolio outside of the U.S. market, and over 78% in Asia. This was the second worst performer, paying out only 67% expected, a $220 shortfall. Equity appreciation, however, is up 12% for the year.

Lastly, SCHF only paid out 75% (about $250 less than expected). This is another international ETF with large holdings in Europe and Japan. Once again, equity is actually up over 7% for the year.

Hopefully the trend above is obvious – dividends for international holdings got clobbered, while the U.S. funds performed well.

The fact that Carnival Corporation (CCL) paid basically zero this year goes without saying! Not a lot of demand for cruises during a pandemic. I didn’t expect to get anything at all from CCL this year, it was purely a play for the future. Other than a small March payout, every subsequent dividend was suspended, no surprise there. I’m not counting on it to bounce back until 2022 or later.

Looking forward to 2021

What’s going to happen in the financial market this year? Now more than ever, it’s anyone’s guess.

Recovery curves

In the best case scenario, we’ve had a V-shaped recovery already, where the market losses from the pandemic have been made up for by the increase. That doesn’t mean that unemployment rates, small businesses, service industries, or many other areas have recovered or will soon, though.

A U-shaped recession would have seen it take many months, or even multiple years, for the economy to make up its losses. (This was the case for the Great Recession in 2007, which took years to recover.) This doesn’t appear to be the case with what the market data has already shown.

A W-shaped recession has an initial drop and a quick market recovery, followed by a second drop and recovery, hence the ‘W’ shape. This is still a major concern for many as Covid-19 continues to spread. If the vaccine rollout doesn’t go as planned, or herd immunity takes longer to achieve, or new resistant strains of the virus emerge, longer rounds of lockdowns and quarantines could continue well into 2021.

Unemployment Data

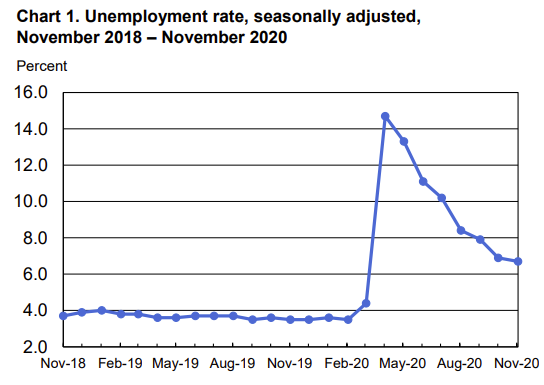

The latest data from the Bureau of Labor Statistics shows that the unemployment rate in the U.S. has dropped down to 6.7% in November, and was the same in December. It was up to 14.7% in May 2020, so this decline is pretty amazing. (Remember when comparing to older data that these are monthly, not annual, rates. I have more details on that and a chart of unemployment history back to 1929 here.)

Other interesting items from this report show that almost 22% of those employed are teleworking because of the coronavirus pandemic, while 3.9 million unemployed persons are willing to work but are prevented from looking due to the pandemic. Many industries are still adding jobs, despite obvious declines in retail, leisure, and hospitality.

2021 Outlook

I’m personally optimistic that business adjustments to the “new normal” of remote work, coupled with vaccine rollout to keep ICUs staffed and more people out of the hospital with reduced symptoms, will have the combined effect of stabilizing things by summer 2021. I also believe that there’s a huge pent-up demand for leisure travel and “living life” that will explode once destinations, cruises, hotels, and restaurants can re-open.

It’s unclear to me what the longer term effects will be for small businesses, especially restaurants, and lower income families that have struggled severely. I have my fingers crossed that people are able to weather the storm, keep their homes, and that restaurants and tourism can bounce back quickly.

Regarding my own personal finances, I haven’t run the numbers yet, but I expect to be pretty close to last year’s estimate, if not a bit above. I’m expecting dividends to pick up in the second half of 2021 and more than make up for the 6% dip this year.

I hope this article was interesting. I enjoy looking back at my finances for the year to assess how things are going, especially since using investments for a primary income source is new for me (and still pretty weird). I also enjoy looking forward and remain hopeful that 2021 will be a year of resilience and coming back stronger than ever. Thanks for reading!