As I did last year, I spent some time predicting what my dividend income will look like for 2020, and wanted to give an update on how things look.

Using the past to predict the future

Everyone has seen those “the past is not an indicator of performance” disclaimers, which is of course true, so predictions are just that – estimates that could easily be affected by market changes. In fact I saw it firsthand when my REIT ETFs underperformed thanks to the Federal Reserve cutting interest rates. That said, here’s the simple methodology I follow.

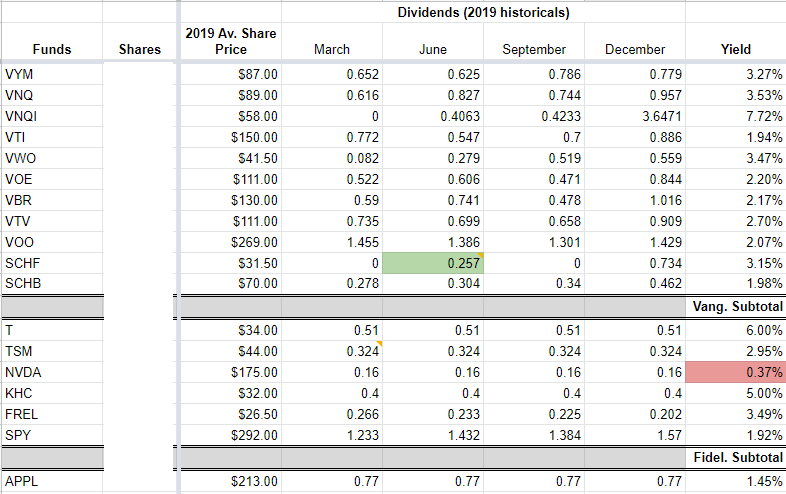

First, I look at the dividends from last year (2019 in this case, and most are paid out quarterly) and use those rates as a baseline. If you’re lucky, you’ll see upside as dividends increase – AT&T (T) usually inches up a penny or so each year, for instance. In some cases, they’ll decline substantially – Kraft Heinz (KHC) cut theirs from 0.625 to 0.4 when their stock plummeted last year.

Second, I determine a rough average share price for the year looking at the stock history. I then compute the yield, so I can see the percentage return. (Websites can do this more accurately, I find it a helpful exercise to keep abreast of the fluctuations as they go up and down with share price changes.)

With this information, I simply multiply (number of shares held) x (dividend amount) to arrive at a quarterly predicted payout.

2020 Dividend Cash Flow

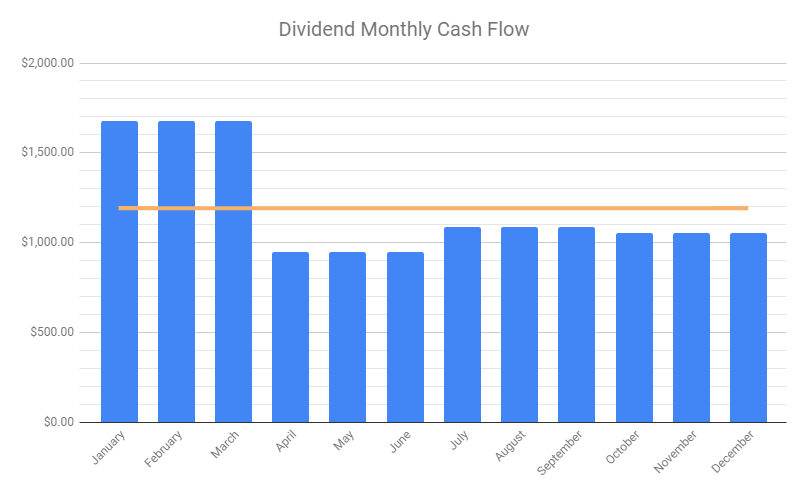

Last year, I predicted an average of about $1,000/month, and actual performance exceeded that at $1,110/month from June through November. (December was actually an even bigger performer, but I’ve left it out since it skews the results a little too positively without a longer measurement duration.) This year, I’m estimating just under $1200/month ($1,191) before taxes, about $14,300 for the year.

Conclusion

It’ll be interesting to see how the market performs this year with an upcoming presidential election, supposed additional cuts to the interest rate, and the inverted yield curve in August 2019 supposedly spelling future disaster in the next 6-29 months. Thanks for reading!

1 Comment