2022 will be remembered as a crazy year for the financial markets. I can’t even count how many times I heard finance professionals use the word “unprecedented” in the news.

As I did last year, and every year since 2019, it’s time to take a look back at my own predictions and performance. This year I was totally right and totally wrong at the same time.

2022 Market

The S&P 500 dropped 22% in 2022. The Russell 2000 (small-cap stocks) went down 19.5%, so this drop affected the entire market, large and small.

Apart from the dip in 2020 from covid, which was rapidly erased, it’s been a long time since the stock market has had a sustained drop. How long?

This is the largest drop since the mortgage crisis, which we began to emerge from by early 2009. It’s therefore been about 13 years since an event like this.

Funny story: I was visiting my friend Keith in Seattle this November, and his buddy was hosting a financial meetup, so we joined in the back. As he sat down in front and introduced the three panel speakers, who are all financial experts, he opened with: “In this unprecedented market drop, which we haven’t seen in our lifetime…”

I raised an eyebrow and glanced at Keith. What is he talking about? What about the housing crash in 2008? And the dot-com burst in 2000?

It was then that I realized that he must only be in his mid-thirties. Anyone under the age of 35 has only known a stock market in their adult life that has continually gone up, until now. Wow. Talk about feeling your age! I’m not that much older, but I’ve lived through two other dips. I believe this is also why younger financial analysts are feeling more anxiety, and even panic, in these times. It’s one thing to see lines in the past drop on paper, it’s another to watch your balances decline on E*TRADE. If it’s happened to you before, and things have eventually recovered, you don’t take it to heart quite so much.

Anyone under the age of 35 has only known a stock market in their adult life that has continually gone up, until now.

2022 Dividend Performance

Ok, so the market is way down. What does that mean for dividend investing?

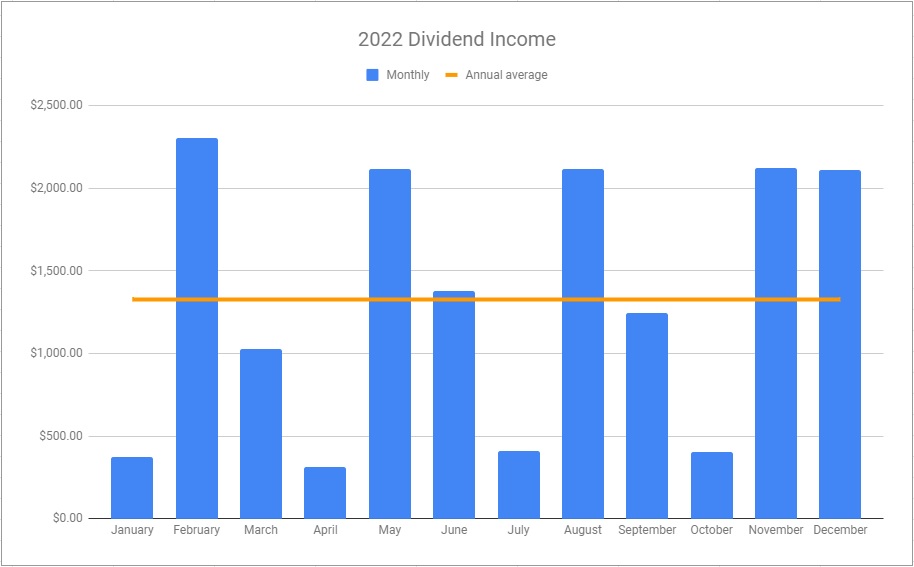

Every year I predict (read: guess) what’s going to happen in the next year, and work that into my tracking spreadsheet. For 2022, I put in a 15% drop compared to 2021’s initial prediction (which was exceeded, since the market shot up 27% that year). I knew the market was going down, so if dividends also got cut, that would have resulted in income of about $1,020 a month. And hey, the S&P actually went down 22%, so that’s not too far off. So how did things actually perform?

Really, really well. Unexpectedly well. My average ended up at $1,327 a month, or $15,927 for the year. That’s 30% higher than what I’d hoped for in my prediction, and actually 2.4% higher than what I got in 2021, which was a banner year.

I found this to be pretty shocking. Most of my holdings are tech stocks, REITs, and other index-tracking ETFs that largely rise and fall as the S&P 500 does, yet the dividend payouts for 2022 were unaffected; in fact, they increased. Some may drop slightly next year (TSM has already fallen a bit for 2023), but others have increased and held.

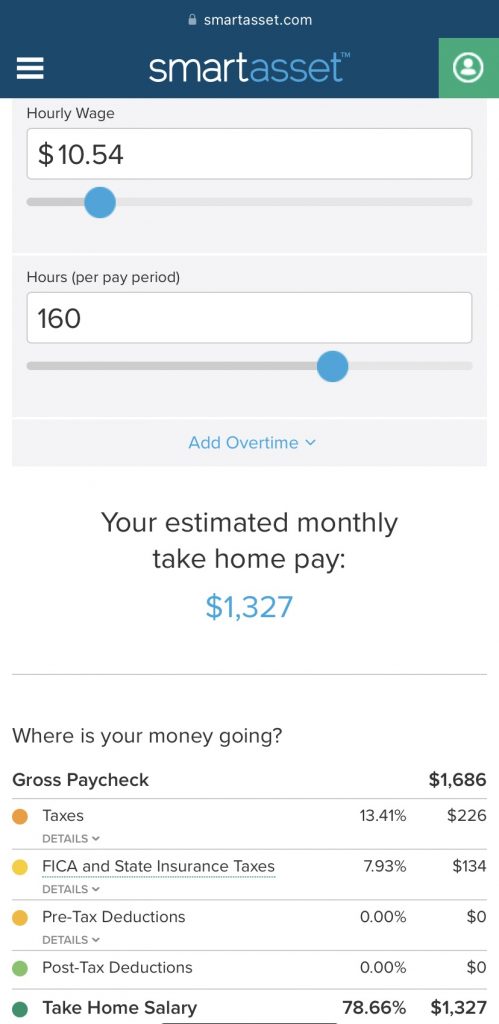

Put another way, to make this amount as take-home pay in my current state (New York) would require working a full-time job at $10.54 an hour.

I also think it’s worthwhile using this as an example of the value of dividend investing in a bear (declining) market. Lots of investors really dislike dividend stocks, arguing that they leave too much money on the table, and would rather invest in straight growth stocks and sell them periodically for a payout. However, when markets fall 20%+ like this, do you really want to sell at those prices? Dividends are a “set it and forget it” income that can be really appealing.

Dividend investing isn’t for everyone, but in certain circumstances it works very well, and this year was one of those for me.

Specific Stocks and Funds: All Outperformed

Normally I identify good and bad stocks and ETFs for the year, but they all met or exceeded goals this year. The real estate funds (VNQ, FREL) were 9% over expected this year. AGNC is still paying a $0.12 monthly dividend per share, which is a crazy ~12% annual dividend (though share prices have declined substantially, erasing some capital). TSM was 25% higher. My only big change for 2022 is that AT&T split off their Warner Brothers Discovery division, which has no dividend, and substantially reduced the dividend on their traditional stock. I have to decide if I’ll keep WBD or get rid of it, it’s fallen quite a bit already.

2023 Outlook

Total. Crapshoot.

Ok, maybe we can do slightly better.

- The Fed is going to keep on raising interest rates until they think inflation is under control. The extremely difficult trick is to stop before driving the economy into a recession. Will they succeed? Nobody knows, but they’re aiming to hit a 5-5.25% federal interest rate before they even consider stopping, which makes borrowing money more expensive (car loans, mortgages, etc.).

- Some lumber prices have finally come back down. Overall, Lumber futures (LBS) indicate things look good for builders and renovators, so it’s possible contracting costs may decrease, though there’s still a skilled labor shortage.

- Vehicles remain inflated and chip shortages still very much exist, with some new vehicles arriving with parts missing or missing features. I think this could easily continue for another year.

- Big Tech has laid off over 200,000 workers in 2022 and January 2023. Overall unemployment is still low at 3.5%, but this specific sector was hit hard.

If the Fed stops raising rates, I could imagine a market bounce-back in the summer. If costs keep spiraling, and eggs get any more expensive (currently $5/dozen), a recession is going to take hold.

Thanks for reading, I hope these once a year updates are interesting. Feel free to leave a comment or ask questions.